Follow: YouTube | Apple | Spotify | Google

Software Startup Idea: Helping enterprises secure their mobile apps

Please introduce yourself and the journey of your software startup idea. How did you discover your ICP (Ideal Customer Profile)?

My name is Harshit Agarwal, and I am the founder and CEO of Appknox. We started our company with our software startup idea back in 2014. Back then, we saw a lot of enterprises moving to the mobile-first approach.

Our ICP (Ideal Customer Profile) that we initially aimed for were internet companies that used to raise funding or release mobile-focused applications. We used to reach out and convert them to being our customer.

For us, ICP discovery has been an ongoing process revolving around the same startup idea. But the major change happened between 2017 and 2018, which was a tough phase for us. Within our initial ICP that we chose, half of the early-stage companies wouldn’t survive. For the ones that did survive, we realized mobile is just a one-time activity.

So, in 2017, we went through a very tight process of discovering a more lucrative and sustainable ICP, so we did a lot of customer interviews. At that time, we had zeroed down on three major ICPs and conducted 20-30 interviews with each ICP. Out of these ICPs, we got a fair response, or could match problem-statement with the value we’re offering, was the banking sector. So, in 2017, we zeroed down on banking as our target sector. That’s when our shift from SMB or early-stage companies to enterprise happened.

Within a year, we closed around six banks with an ACV (Annual Contract Value) of roughly around $20K, and almost doubled our revenue, during 2018.

In short, we were able to discover a better ICP and increased our reach outside India to capture more enterprises within the same ICP. Today, we’re working with Fortune 500, along with the MSSP (Managed Security Service Providers). We’re also continuously figuring out other different ICPs and growing towards the next stage of our journey.

Explain your method of reaching out to early-stage companies which you were trying to sell to, in the beginning, and then to banks?

The methods that worked well for us from the beginning and are still working are LinkedIn and email. The good part about our offerings is that we can detect those security issues early in our prospects mobile apps before we reach out to them.

In the early days (2015 to 2017), we used to find security issues in mobile apps and reach out to their co-founders, CTOs and tell them “Hey your mobile app is vulnerable”. Then, we would point them that they need a platform like Appknox to keep the apps secured.

We reached out through LinkedIn. Initially, it was challenging. I think we reached out to around 70 to 80 CSOs (Chief Security Officer) in our ICP and we got responses from 5-7 of them. But once we were able to connect with one or two of them, it became fairly easy to get recommendations and connections from them.

How did you validate clients’ willingness to pay?

We never tried to pitch our software startup idea on the first call. Otherwise, clients could set a perception for us, and we might get false answers, resulting in us not validating it correctly.

So, we used a consultative approach. Our basic question was: “What are the security challenges with your mobile app?” This was really helpful because while discussing we were focusing on their current challenges, what are they doing today, where are they seeing loopholes or what’s not working for them. This gave us a clear idea on what bottlenecks these CSOs were facing in mobile security.

We transformed the challenges they shared into our marketing messaging on our website, emails, etc., This approach really helped us ensure that we got clarity on bottlenecks.

Later, we used to map these bottlenecks/challenges and our offerings. Can we really solve these challenges with what we have in hand? How can Appknox help them? Many CSOs saw a value in our offerings. So, these were easy wins for us.

When we moved from tech to enterprise, overall deployment time for making our product ready for enterprise also took us almost 6-8 months. They wanted SSO and a few other enterprise specific features that we didn’t have. And none of the SMB had actually asked for it.

Appknox KPIs

We’re at $1.7M ARR with Around 70 something paying customers, roughly on average paying $20K per year.

- Annual churn rate: 1-2%

- Annual NRR: Around 103%

- Net dollar retention: 101%

How long does it take to recover your sales and marketing spend?

The CAC (customer acquisition cost) recovery period is only 3-4 months. It’s only about adding more of these enterprises as we scale up.

I think most of the churn we see are in the lower segment of customers because they’re not our ideal ICP as we are scaling up and growing. And that is a good churn to have.

Which distribution channels worked, and which didn’t for your software startup idea?

LinkedIn and email are what we started with. But eventually inbound became a primary channel. During the last four years, the majority of leads that we have generated have been through inbound. We’ve progressed into becoming a more inbound-dependent channel.

Outbound depleted to almost zero up to early last year. Early this year, we started doing outbound again. So, recently we have picked up LinkedIn and outbound email as additional channels again.

Apart from that, one of the channels that has been very effective for us is resellers. Here, we look at MSSPs who are already selling product offerings around other different cyber security areas. For them, upselling or cross-selling Appknox is just another product that they’re adding with similar ICP and customer segments. So, we try to onboard more of these MSSPs and that has been a very effective channel.

In cybersecurity specifically, I think there should be trust between the acquiring company and their partner. With this level of existing trust, they can onboard another OEM. So, we just try to work with those MSSP and try to enable these enterprises through our automated security testing solution.

As a result, OEMs and MSSPs can further sell their services over and above our platform. So, there is more value added for them also. Also, if they want to reach out to new clients, we can be an entry point for them. Then, they can cross it and upsell on a bigger platform where ticket sizes are in the levels of $100K.

What are your models of working with distribution partners?

Deciding distribution channels is an important step when creating a business plan. Any channel we use ideally makes nearly 30-40% as profit margin for any sale that happens. This motivates the channels to do more of these sales. As I mentioned, one of the good points that Appknox has is that it’s very easy for the reseller partner to pitch in and win a lower ticket size of $20K. Then, they can look at selling bigger offerings that they have of $100K, $200K.

So, that creates a good entry point for these enterprises to set their foot in the door. Then, they try to increase their business from these bigger enterprises that we are chasing in the region.

The third and most important distribution method is that they already have a working relationship with these CSOs in those regions. So, it’s very easy for them to just reach out to them with their offers. I think we have a system where once the POC (proof of concept) is successful, we have a structured process to drive it to their sales rep.

Then, we help the sales rep convert the client together. With that kind of support, it becomes very easy for them to just initiate that first level of connection and we help them close the deal.

Do they make 30%-40% of your ACV (Annual Contract Value) for the first year or all years?

All years. We give them 30% of the price for which we are selling to the end customer.

Do you bill the channel or the customers, and then pay them a fee?

Yes, we bill channels, and channel bills to the customer. This is because most of these regions we work with, such as the Middle East or Southeast, involve cross-border payments. So, it’s better that we have channels taking care of their billing. But we keep the support functions in house.

What have been the challenges throughout your journey, and how have you overcome them?

There are always challenges. They just keep on evolving. During initial days, when we succeeded raising initial funding, we felt that fundraising is a victory. But later, we realized that we should have done it the other way around.

So, learning the hard lesson of finding profitable ICP first, helped us ensure that we grow without losing money. So, we follow the value SaaS (Software as a Service) models making sure that for every dollar we invest, we make at least $1.2 out of it.

But this makes the overall growth of our software startup idea comparatively slower for us. That is a challenge we are going through. So, we’re changing the entire company from being first and foremost very price sensitive, to a more risk-taking aggressive approach. This is a significant change for us.

Personally, I am facing issues in trying to go through that change. We’re trying to transit ourselves from a slow growing but profitable company to a fast-growing company, while burning money as well. We are still figuring out how we should do that and succeed with that particular change. But I’m sure, we’ll figure it out as we have succeeded to transition in the past.

Apart from that, I think, we are also trying to grow in few of the regions.

We have been building a niche leadership. But there are countries, especially the USA and Europe, where we are not at all present.

Please share go to market ideas or experiments that you’re considering going forward.

We have done a lot of experiments, some of which have not worked, and few have worked. For example, in sales, we have these competitive pages such as Appknox versus ABC, Appknox versus X. So, we tried creating something similar, but we realized that it backfired because we got a notice from some of the bigger competing players saying that we were not allowed to name them on our website and say how we are better. That is one experiment that happened very recently.

Apart from that, we are running many ad campaigns very actively. I think overall ad spend has almost grown to three to four X since last quarter. Earlier we were spending roughly around $2K, $2,5K. Now, it’s roughly around $7K to $8K that is a serious investment for us.

Apart from that, I think hiring in the US is another experiment as we want to scale up in that region. It’s very expensive on payrolls. If we hire in the US, we will probably need to wait two to three quarters before we get to see any tangible result. So, ROI can be measured after a year from the moment we invest in US hiring.

Apart from that, I think we have started a lot of outbound activities such as cold calling and emailing. And that has worked as an efficient experiment. Cold emailing is something that we have doubled down on in the last quarter, and that has shown some effective results.

For a 50-member team with $1.7 to $2M revenue, we are conscious of the costs of different experiments.

Which books, tools, podcasts and blogs would you recommend for other entrepreneurs considering software startup ideas?

I recently read the book from Ben Harrowitz Hard Things About Hard Things. If I would’ve read this book five years back, I’m sure the way or where I would have been with Appknox would have been completely different. There is a lot of learning from it for our software startup idea. The other is Multipliers because as we were growing our team, I realized how, the team that we are hiring, their motivation and where they are heading are very important. Multipliers is a book that any founder should read.

Two big tools I recommend are HubSpot and Slack.

HubSpot is a product that motivates me because it gives a clear journey of how a customer grows within it. Similarly, the way Slack integrates with other tools makes it a must-have tool internally.

Ideally, I don’t open my emails so often. Slack and HubSpot together keep me updated on whatever is happening.

What opportunities are you looking for across fundraising, or sales & marketing?

At this stage, we are primarily looking to grow our software startup in some of the Western countries. We are looking for active channel partners in these regions. Apart from that, we are also hiring for some of the leadership positions like engineering manager reps and sales.

What about acquisitions or partners?

MSSPs, definitely yes. Acquisition and fundraising are not high up in the priority list. If there are cybersecurity-specific investors, we’d be happy to interact with them and understand how they can help us.

Appknox summary in a nutshell

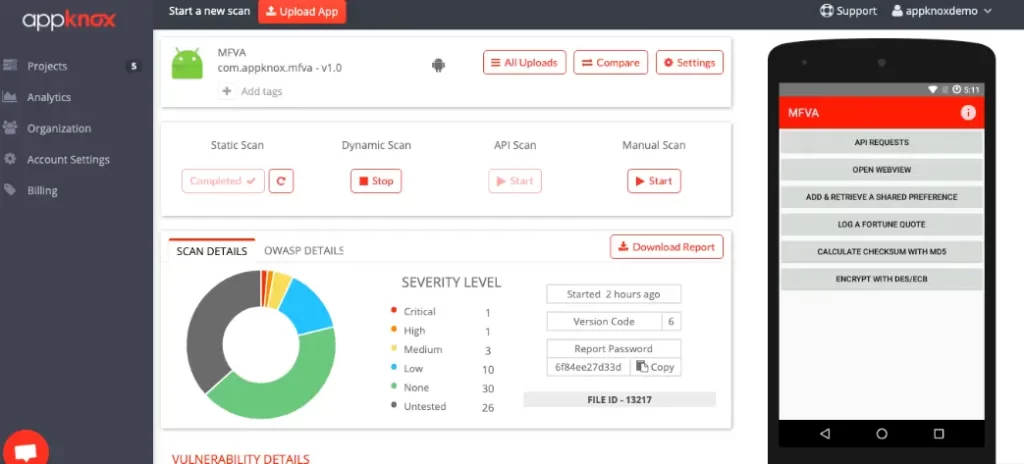

Harshit Agarwal, founder and CEO of Appknox in the mobile security space, differentiated with security quality for mobile apps using real devices rather than emulators, making $1.7M ARR serving more than 70 customers.

Appknox is looking to expand in the US and Europe, looking for channel partners, sales and customer support talent.